Taxes

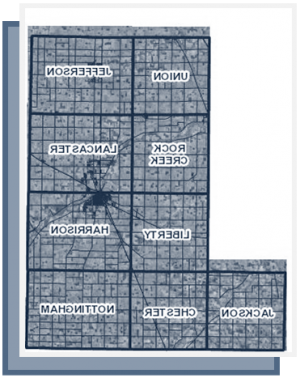

2023 Wells County Property Tax Rates (Varies by Township and City)

Township Tax Rate

Chester 1.0431

Poneto-Chester 1.7781

Harrison 1.3832

Bluffton-Harrison 1.8039

Ponteo-Harrison 2.0485

Vera-Cruz 1.4891

Jackson 1.0159

Jefferson 1.3075

Ossian 1.5818

Lancaster 1.3469

Bluffton Lancaster-Norwell 1.7676

Bluffton Lancaster-Bluffton Harrison 1.8150

Liberty 1.0899

Poneto-Liberty 1.7844

Nottingham 1.0567

Rockcreek 1.2897

Markle-Rockcreek 2.2704

Uniondale-Rockcreek 1.5974

Union 1.2789

Markle-Union 2.2609

Uniondale-Union 1.5879

Zanesville-Union 1.5017

Indiana Tax Information

Indiana ranks 1st in the Midwest and 5th nationally in the Chief Executive's "2018 Best and Worst State's for Business" (May 2018).

Indiana Ranks 2nd as the "Most Affordable State" according to U.S. News (May 2018)

Corporate Income Tax

The Corporate Adjusted Gross Income Tax is calculated at a flat 6.25 percent of adjusted gross income. Adjusted gross income is a company’s federal adjusted gross income with certain adjustments. This method of determination simplifies tax calculations for corporations and does not apply to S corporations and not-for-profit organizations.

* Indiana's corporate income tax rate is decreasing from the current 6.25% to 4.9% by 2021.

Gasoline and Diesel Fuel Taxes

The combined federal, state and local tax on gasoline in Indiana is $0.483 per gallon. The combined

federal, state and local tax on diesel fuel in Indiana is $0.632 per gallon.

Gross receipts and Inventory Tax

Indiana has no gross receipts tax and no inventory tax.

Individual Income Tax

Indiana’s personal income tax is 3.23 percent of federal adjusted gross income (with certain exemptions and deductions).

**Personal income tax rate decreased from 3.3% for 2015-2016 to 3.23% for 2017 and beyond.

Wells County personal income tax rate is 2.1 percent, including County Economic Development Income Tax (CEDIT) .45% of Individual Adjusted Gross Income.

Sales and Use Tax

Indiana’s Sales and Use Tax is tax is calculated at a rate of 7%. In manufacturing, the following are exempt from the sales tax: raw materials, equipment, power, electricity, and utilities. Wholesale sales, items used directly in production, and sales made in interstate commerce are exempt. In addition, the purchase of research and development equipment is exempt from the tax.

Business Property Tax

There is a 3% cap on Indiana's business property tax.